Balance sheet CA Certified?

A CA-certified balance sheet is a financial statement verified by a Chartered Accountant, ensuring accuracy, compliance, and transparency.

- What is a Balance Sheet?

- What Is Included in the Balance Sheet?

- What is the importance of a balance sheet?

- Balance sheet example

Balance Sheet

Today's Offer

Balance sheet Overview

A CA-certified balance sheet is a financial statement verified by a Chartered Accountant (CA) to ensure its accuracy and compliance with accounting standards. It provides a snapshot of a company’s financial position at a specific point in time, listing its assets, liabilities, and shareholders’ equity. The certification process involves reviewing the company’s financial records, transactions, and accounting methods to ensure they are correct and conform to legal and regulatory requirements. A CA-certified balance sheet is essential for businesses seeking loans, investors, or regulatory compliance, as it adds credibility and transparency to financial reporting.

What is a Balance Sheet?

A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date. It helps evaluate a business’s capital structure and also calculates the rate of returns for its investors.

Moreover, you can pair a balance sheet with other financial statements to calculate financial ratios and conduct fundamental analysis.

What Is Included in the Balance Sheet?

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

What is the importance of a balance sheet?

A balance sheet is an essential component that assists in the smooth running of a business. Here are some of the reasons that explain the importance of a company’s balance sheet:

- Assist banks in evaluating a firm’s net worth

When a business wants to expand its operations and make future investments, it seeks loans from banks. Under such circumstances, the banks will look at the firm’s balance sheet to evaluate whether or not it has the financial position to pay back the loan amount.

- Helps investors take decisions

While choosing a firm for the purpose of investment, a majority of investors look at the company’s balance sheet to determine its financial position. Moreover, they combine it with various other factors to assess the firm’s future growth potential.

- Serves as a determiner for risk and returns

If you are a business owner, maintaining a balance sheet will enable you to determine the ease at which you can meet your short-term obligations. Furthermore, you can also put a check on the liabilities of your business if they are rapidly growing and avoid the chances of bankruptcy.

- Enables financial analysis

Having a proper balance sheet will let you get a clear idea of the liquidity conditions of your company. Thus, you can view the cash flow of your firm, working capital funding, trade receivable status and also how much daily transactions your business can afford.

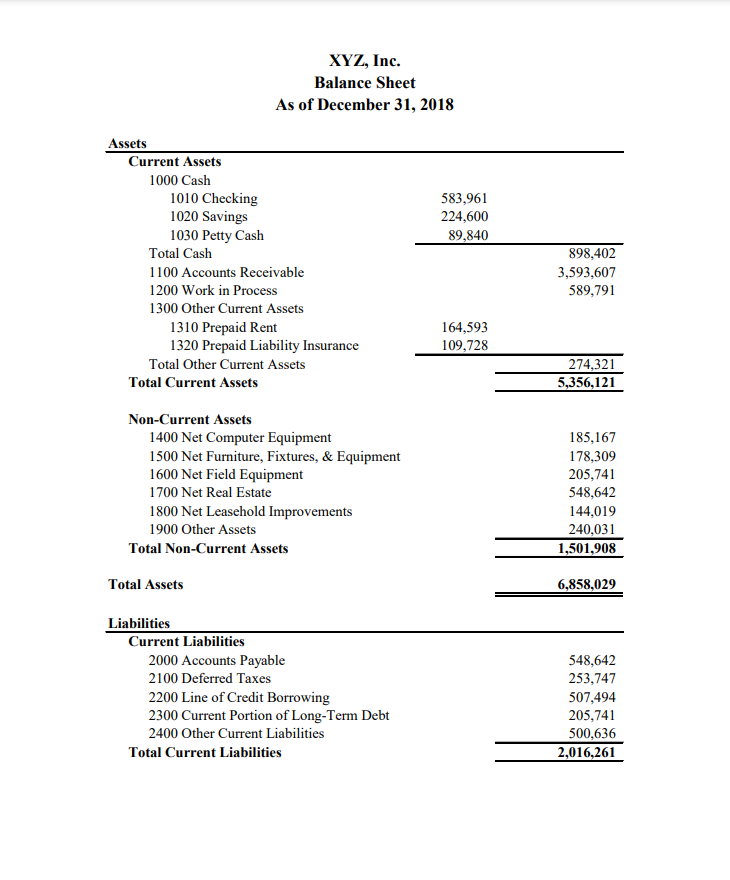

Balance sheet example

FAQ ON CA CERTIFIED BALANCE SHEET

A CA-certified balance sheet is a financial statement that has been reviewed, verified, and certified by a Chartered Accountant (CA). It ensures that the financial records are accurate and comply with relevant accounting standards and regulations.

- It provides credibility and transparency to the company’s financial health. It is often required by banks, investors, and regulatory authorities for purposes like applying for loans, raising funds, or filing taxes.

It is typically required during audits, loan applications, tax filings, investor reports, and in compliance with statutory requirements for businesses.

A CA certifies the balance sheet by reviewing the company’s financial records, ensuring proper documentation, verifying transactions, and ensuring compliance with accounting principles like GAAP or IFRS.

- Without CA certification, the balance sheet may lack credibility, potentially leading to issues in securing financing, attracting investors, or meeting regulatory requirements. It could also raise concerns about the accuracy of the financial data.