Turnover Certificate

A turnover certificate is a document issued by a chartered accountant verifying a business’s total annual revenue or turnover.

- What is CA turnover certificate

- What is the process to obtain a turnover certificate?

- Who can issue a turnover certificate in India?

- Where is the turnover certificate required?

Turnover Certificate

Today's Offer

Turnover Certificate Overview

A turnover certificate is an official document issued by a Chartered Accountant (CA) that certifies the total revenue or turnover of a business for a specific period, usually one financial year. It is commonly required by banks, financial institutions, and government authorities for various purposes, such as applying for loans, tax assessments, or participating in government tenders. The certificate provides a verified statement of the business’s financial performance, offering transparency and accountability. It may also be used in tax filings, audits, or compliance reports. Accurate turnover certification ensures the credibility and financial health of a business.

What is CA turnover certificate

A CA Turnover Certificate or annual turnover certificate is like an official stamp from a Chartered Accountant, confirming the total turnover of your business for a certain period. In India, the financial year runs from April 1 to March 31, so the turnover is calculated over this period. It’s proof that your business hit the turnover mentioned in the certificate. Whether it’s for a year or more, the certificate’s duration is flexible to meet your needs. Some times sales turnover of some part of the year may also required.

Banks often request it for loans, and governments require it for tenders, among other purposes. This certificate shows turnover details based on either Income Tax Return or GST Returns, as applicable. It is authenticated by a practicing chartered accountant with a unique UDIN number.

What is the process to obtain a turnover certificate?

The process to obtain a turnover certificate in India is very simple :

- Submit the documents as per the Checklist

- Documents are verified by the CA

- A Draft copy of the turnover certificate is shared

- Once the draft is approved a final certified copy is issued by the Chartered Accountant

Who can issue a turnover certificate in India?

The turnover certificate in India is a certificate that provides an assurance certificate to the user about the turnover of a business entity. It is issued by a practicing Chartered Accountant who is specializing in issuing the turnover certificate.

Where is the turnover certificate required?

A turnover certificate is required by anybody willing to get an assurance on the turnover of the entity in speculation. Here are some cases where the turnover certificate might be required.

- For participating in tenders issued by the various companies, local authorities, and also institutes.

- It is also required in the banks and the financial institution for loan purposes.

- Also required by investors to fund an existing or new project/business.

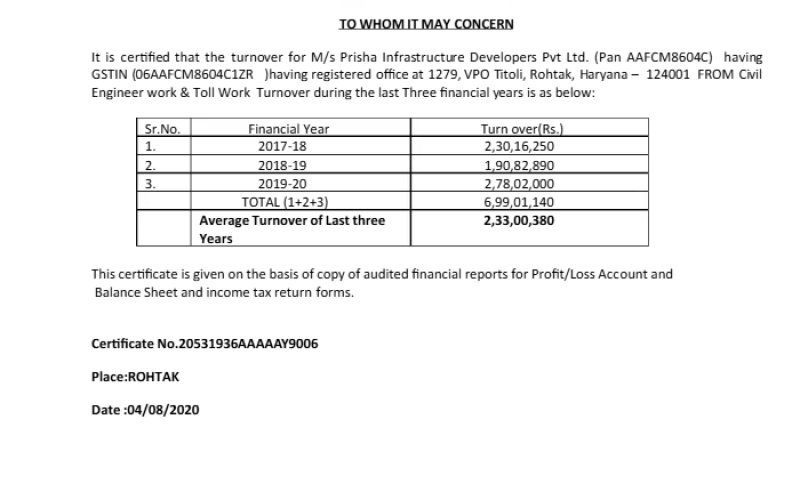

Turnover Certificate Formate

FAQ ON TURNOVER CERTIFICATE

A turnover certificate is a document issued by a Chartered Accountant (CA) that certifies the total turnover or revenue of a business for a specified period, usually a financial year. It is used for various official and financial purposes.

It is required for processes like applying for loans, filing for tax assessments, participating in tenders, or verifying business performance with financial institutions, government authorities, or banks.

A turnover certificate is issued by a Chartered Accountant (CA) after auditing the financial records of the business and verifying the turnover.

Turnover is calculated as the total revenue generated from the sale of goods or services, excluding taxes, discounts, and returns. The CA reviews the financial statements to determine the accurate turnover.

No, not all businesses need a turnover certificate. It is typically required for businesses applying for loans, participating in government tenders, or undergoing tax assessments.